The short answer to this question is yes. If you are buying now, you are getting a good interest rate – but it might not be as good as if you would’ve bought a month ago.

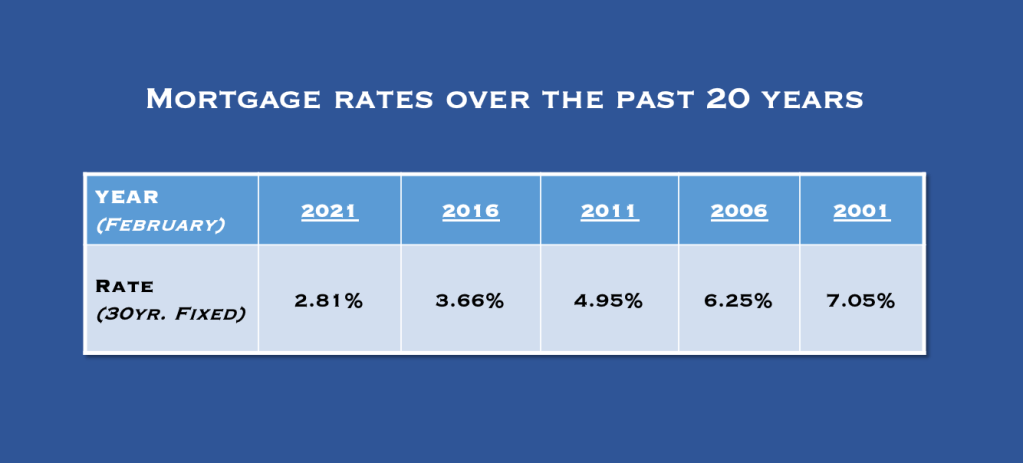

We are all aware that interest rates have been at an all-time low recently. This has been great for the real estate industry because even with it being a seller’s market (low inventory and multiple offers), the low rates have kept buyers in the game. For some historical context, see the table below.

In years prior to what is listed in this table, interest rates were even higher – they were up around 8% in the late 90’s. With that said, If you purchased a home in any of these years, you might want to consider refinancing to lower your mortgage payment with the current rates.

However, the rates likely won’t stay put at multi-decade lows for much longer. Interest rates are already beginning to rise. Today, the average interest rate on a 30-year fixed loan is at 3.17% – up almost a half percent from February. That’s why taking action sooner rather than later is crucial, whether you’re wanting to refinance and cut your mortgage payment or you’re ready to pull the trigger on a new home purchase.

Although mortgage rates are higher today than a month ago, they’re still pretty low on a historical basis. And if you have a strong credit score (one in the mid-700s), and a low debt-to-income ratio, you’re more likely to snag a good deal on a home loan.

The specific rate you get depends on the lender. So if you’re ready to apply for a mortgage, talk to a few. You may find that one lender offers a lower interest rate or closing costs than another, which could save you heaps of money in the long run.

Edina Realty Mortgage has competitive rates and is currently offering a $200 Visa Gift Card just for talking to them and getting a second opinion.

I also have contacts with other trusted lenders so send me an email or direct message on any of my socials linked in the logos below to get the conversation started.

Cheers to all my readers and please come back for more next week.

Brady