Getting pre-approved for a loan is often the first step an agent will tell you to do when inquiring about buying a home, and a lot of buyers have already contacted a loan officer before working with an agent.

Unless you’re splurging on a nice meal, it’s easy to feel overwhelmed by the thought of purchasing something worth so much money. However, hearing someone say they trust you enough to lend the money can be very encouraging. That is basically what a pre-approval letter is; a one page note from a bank or mortgage company that says ‘this person is qualified for a loan from us.’ The letter will often include the amount they will lend you, and sometimes down payment percentage and/or type of financing.

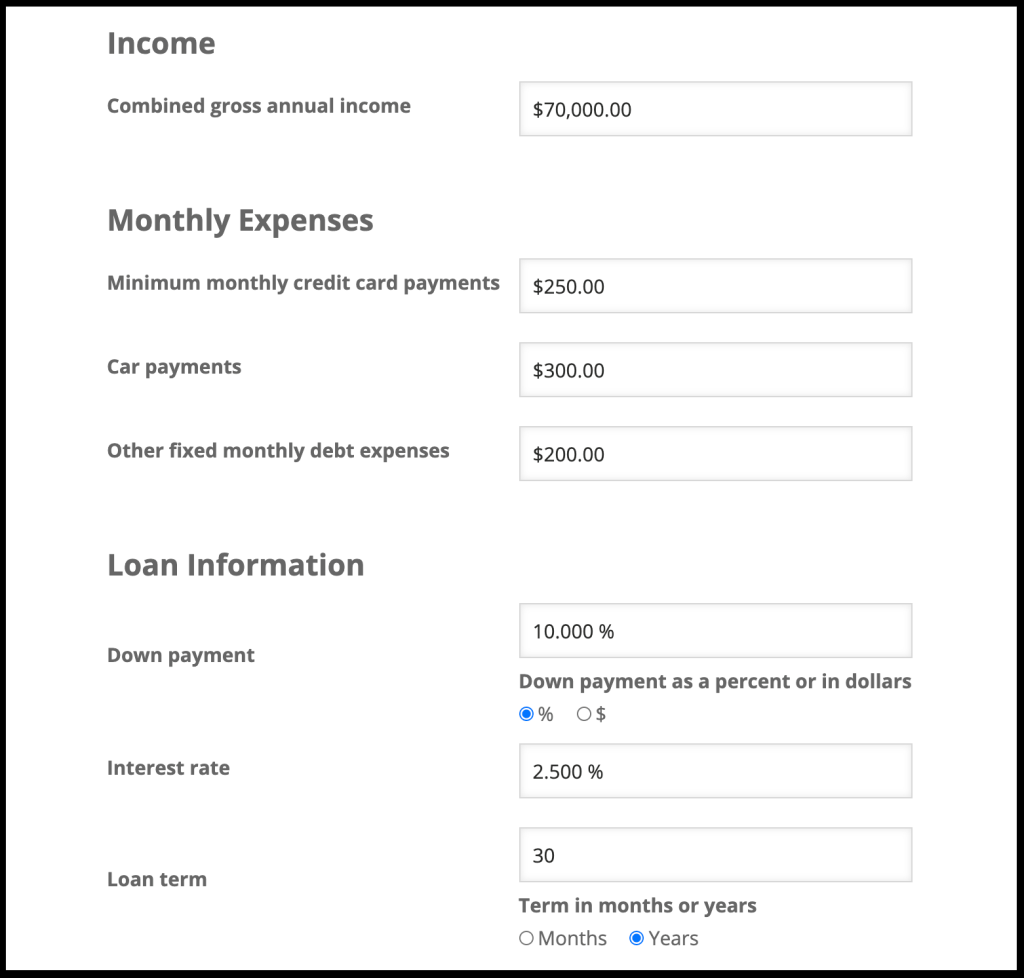

When applying, the lender will ask for information like a credit report, annual income (individual or combined if married), amount of car payments or other debt, how much you have for a down payment, etc. Once they analyze these numbers, they will conclude whether or not they can lend you the money and if they can, they will give you a pre-approval letter.

A lot of times, lenders may ask for a specific amount that you want to qualify for which can be hard to gauge being a first time home buyer. I would advise to do your research and have a general idea first, then start by asking for the highest number you think you can get. There are many online calculators/tools to help you along the way including this one linked in the button below.

It will take you to a screen that looks like the screenshot below. I know, it might seem a bit intrusive asking for so much information, but approximations are OK and if you don’t know just leave it blank or let them fill it for you.

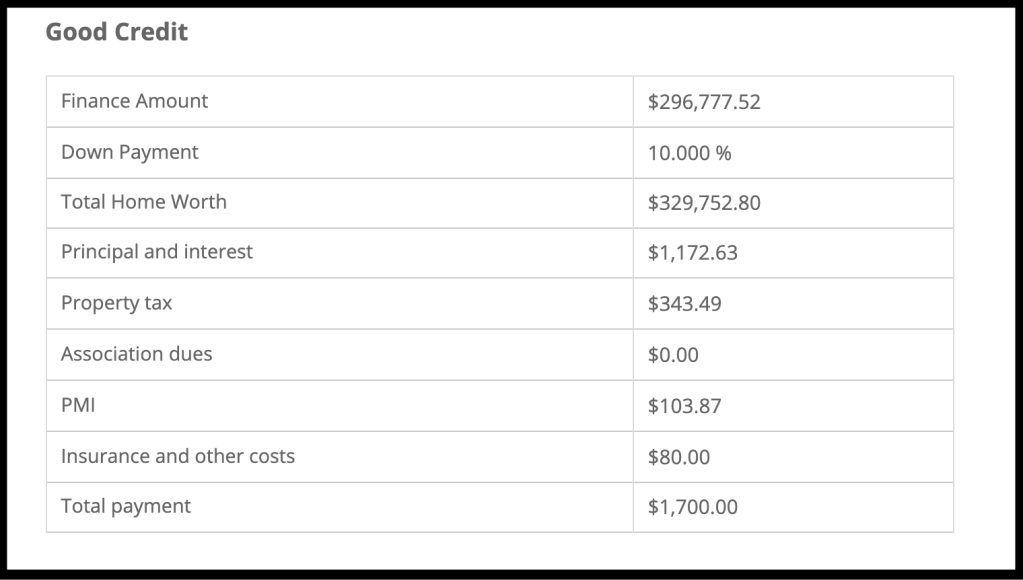

I filled one out as an example for you to see what they give you in return. Once you fill everything in, they will give a summary of the numbers and break it down even further to show what it will be if you have bad credit, medium credit, or good credit.

This gives you an idea of what to ask for before actually talking to a lender. In this example, when applying for a pre-approval, this person could use $300,000 as the requested loan amount.

After doing your research, the next step is to get in contact with a loan officer. Start with your bank or any connection you have to someone in the mortgage world and begin reaching out for information about the types of financing they offer, interest rates, etc. Rates are extremely low right now, so it’s a great time to shop around!

If you’re struggling with where to start, I have a few loan officers I’ve enjoyed working with that I can get you in contact with – just reach out and I will pass on their information.

Email: BradyArthur@edinarealty.com

My agent website and socials are also linked in the logos below.

Cheers to all my readers, and please come back for more next week.

Brady