2020 has been a crazy year to say the least. The pandemic has had a lasting impact on businesses all over the country – most negative, some positive. With millions of Americans losing their jobs, a downward turn in the stock market, and numerous stay-at-home orders, it has been a tough year for many industries across the U.S. However, there is one industry in particular that is trending in the opposite direction – real estate. A perplexing combination of financial struggles forcing people to move along with the lowest interest rates in modern history has made for a very solid year in real estate overall.

This combination is perplexing because even though it is currently a seller’s market, the extremely low interest rates have also made it appealing for buyers. Money has never been cheaper which elevates temptations to take out a new mortgage (on a new home or your current home), hence the influx of refinances we’ve also seen. So many people have been looking to refinance that it has caused delays for many lenders and mortgage companies, but hey I don’t blame people for wanting to basically cut their interest rate in half.

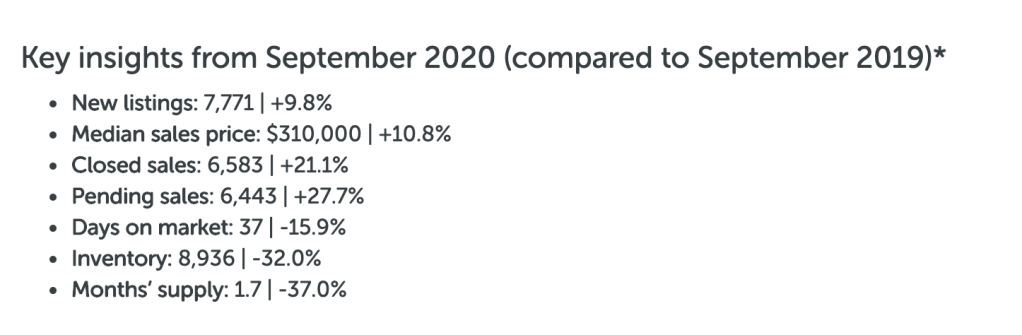

Let’s take a step back for a second as I assume you may be wondering what makes it a seller’s market. A seller’s market essentially means supply can’t keep up with demand, making it easier to sell your house. A good measurement for this is what we call months of supply. Months of supply is the measure of how many months it would take for the current inventory of homes on the market to sell. For example, if there are 50 homes on the market in your area and 10 homes selling each month, there is a 5 month supply of homes for sale. Months of supply is a great indicator of whether a particular real estate market is favoring sellers or buyers. Typically, a market with less than 4 months of supply favors sellers, while 6 or more months of supply favors buyers, and around 5 is a balanced market. According to Edina Realty’s Market Insights, the current months’ supply is 1.7.

Below is a snapshot of some insights from the Twin Cities area.

While most of this (higher prices, low months of supply, decreased days on market, etc.) indicates a seller’s market, since interest rates play such a pivotal role with buyers, a lot of people also want to buy!

These appealing factors on both sides (buying and selling) have produced a successful year in real estate. The question is, what will happen now that 2020 is coming to a close? Well, I’ll tell you my opinion. I think many people are under the impression that as soon as that calendar switches over to January 1, 2021 there will be a fresh start leaving the hellacious year of 2020 in the past. In reality, I believe the current challenges we are facing will still be prevalent well into 2021. On the flip side, this means months of supply and interest rates will likely remain low – helping the real estate market and preventing a market crash like some have anticipated.

During these crazy times, it is important to use the excess time you have at home to reflect and consider whether or not you are truly comfortable enough (physically and financially). Stay home and stay safe.

I have included a list below of some questions you may want to ask yourself prior to buying:

- How long do you plan to stay in the area you are looking?

- How much money do you have for a down payment? Closing costs?

- How set are you financially with your job? Possible career change ahead?

- Are you prepared to spend more on maintenance and taxes than you have as a renter?

And a list for those that are considering selling:

- How much equity do you have in your current home?

- Is refinancing an option? New interest rate(s) you could lock in?

- Are there any home improvement projects to significantly increase the value of your home? Kitchen/bathroom remodels?

- How much do you believe your home is worth?

Cheers to all my readers, and please come back for more next week.

Brady